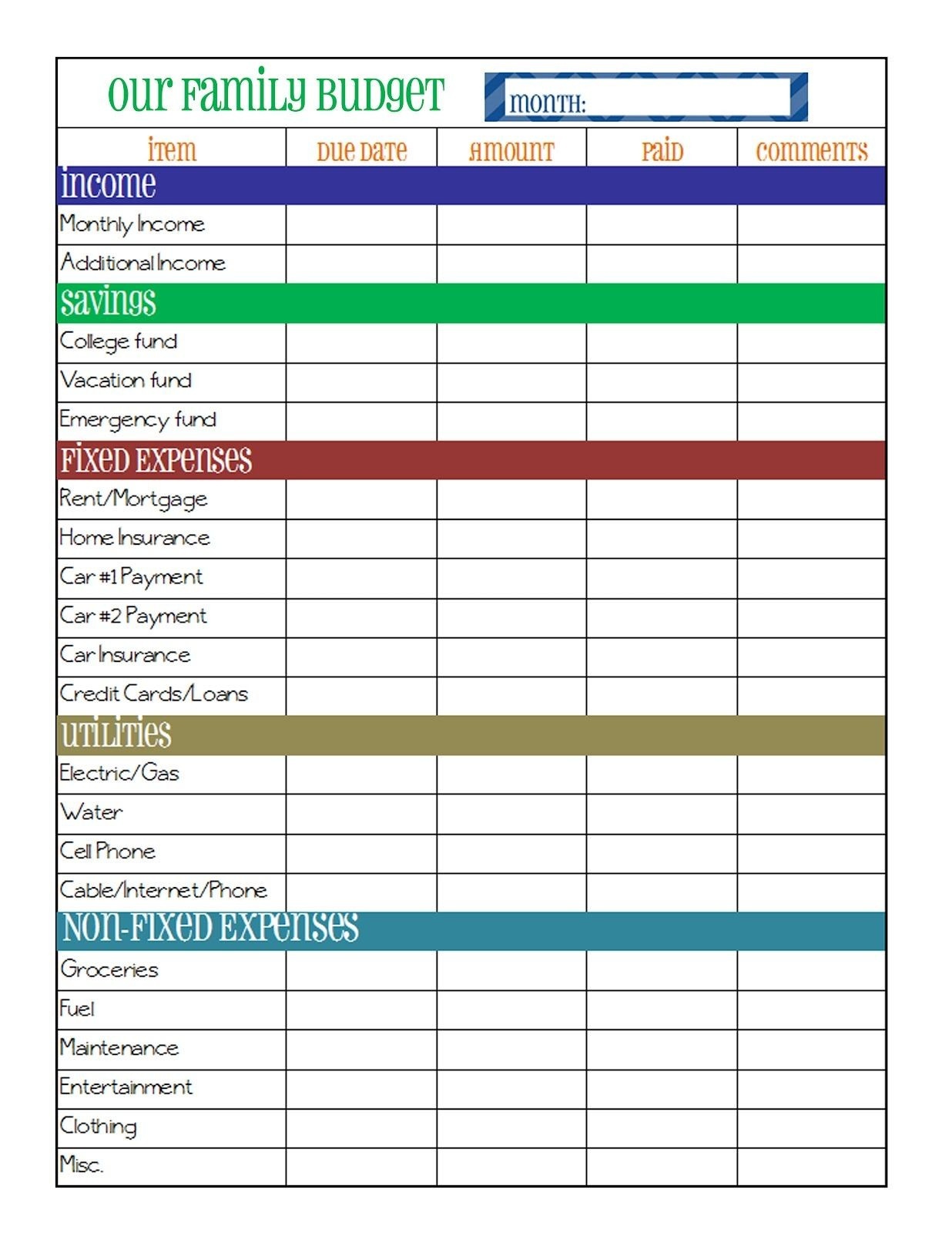

This will show you how much money you have left over each month for personal objectives and discretionary expenditures. Subtract this amount from your monthly earnings. You can discover your overall monthly financial commitments by adding up the prices of your fixed expenses.

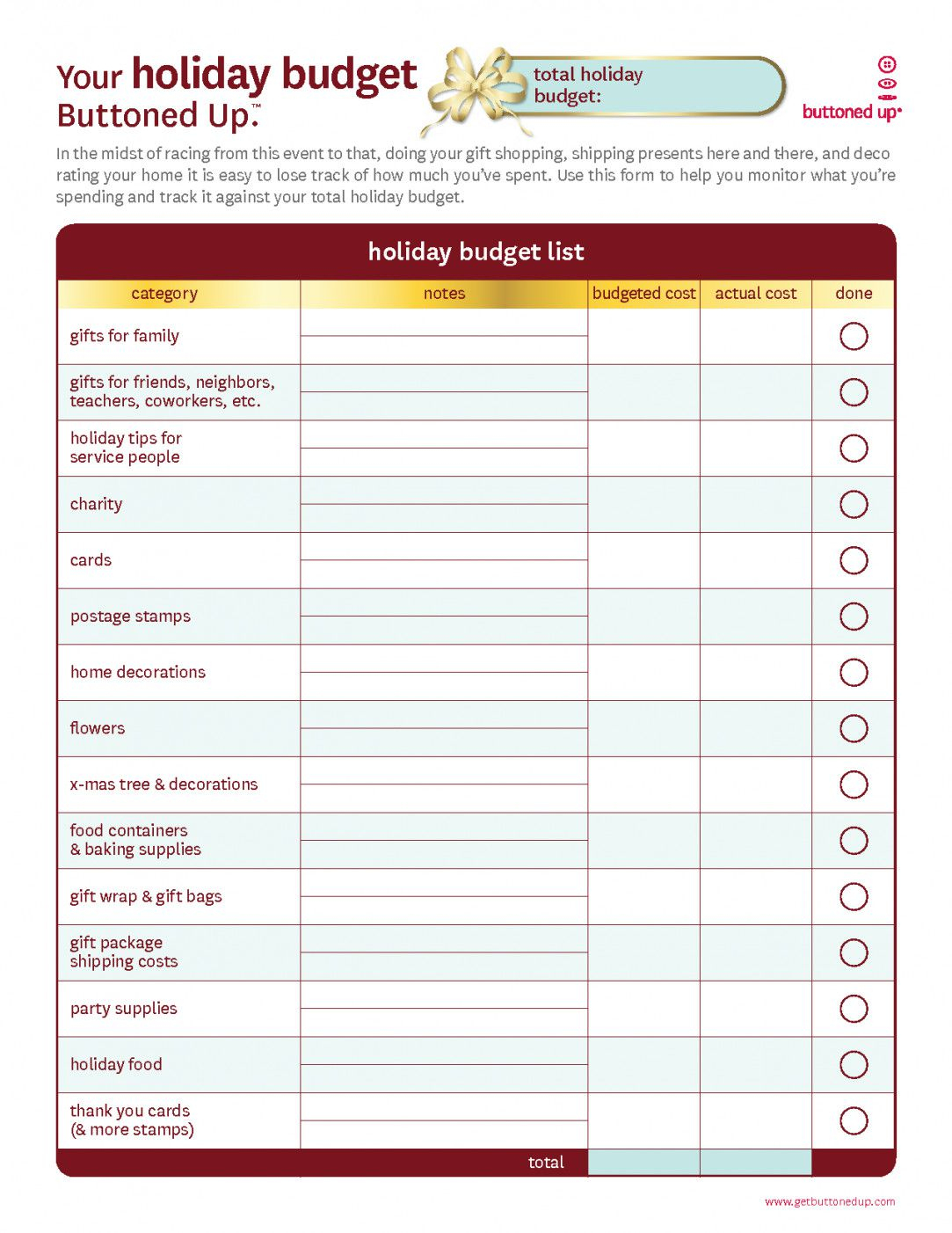

Simple household budget template free free#

A free household budget worksheet can help you with this. If the prices for any of these items tend to fluctuate, calculate the average price for the last three months and use that number. Begin by listing all of your fixed costs, which are the monthly bills that you must pay, such as student loan payments, Internet, food, petrol, auto payments, insurance, utility bills, and rent. It’s time to look at your monthly costs now that you’ve calculated your monthly revenue. Crossing out empty cells with the amount of deferred savings can be a really exciting and motivating activity for you. If you want to save money and do it playfully, you should try the 100 envelope challenge. If your earnings aren’t always steady - for example, if you work a variable amount of hours each week as a freelancer – average your earnings over the preceding three months and use it as a baseline. It’s possible that your monthly income is merely what you bring home from work. You must first determine how much money you have to deal with before you can begin budgeting.īegin by making a list of all of your sources of income, including rental income and money earned from a side job. These methods will assist you in creating a budget and, as a result, become more organized. It may sound scary if you’ve never made or managed a budget before, but it doesn’t have to be. As a result, it’s critical to have a solid, well-thought-out budget.Ī monthly budget will keep you organized and focused on your particular financial objectives on a personal level. Whether you’re making a personal budget to keep your finances in order or working with a large accounting company on a national or global scale, your budget may affect every action or choice you make. One of the most critical components of our life is budgeting.

0 kommentar(er)

0 kommentar(er)